What happened in the last month?

May is generally a time for optimism.

Some of it is genuine, with summer on the way and the thrill of sporting glory as the football season ends and the cricket and rugby league seasons get into full swing.

Others try to manifest the good news – hence the run to summer dresses and shorts at the first chink of sunshine emanating through the stubborn clouds.

So what level of optimism should we be taking from the latest set of corporate monthly insolvency figures that have been issued by The Insolvency Service this week?

“Some” is probably a fair answer.

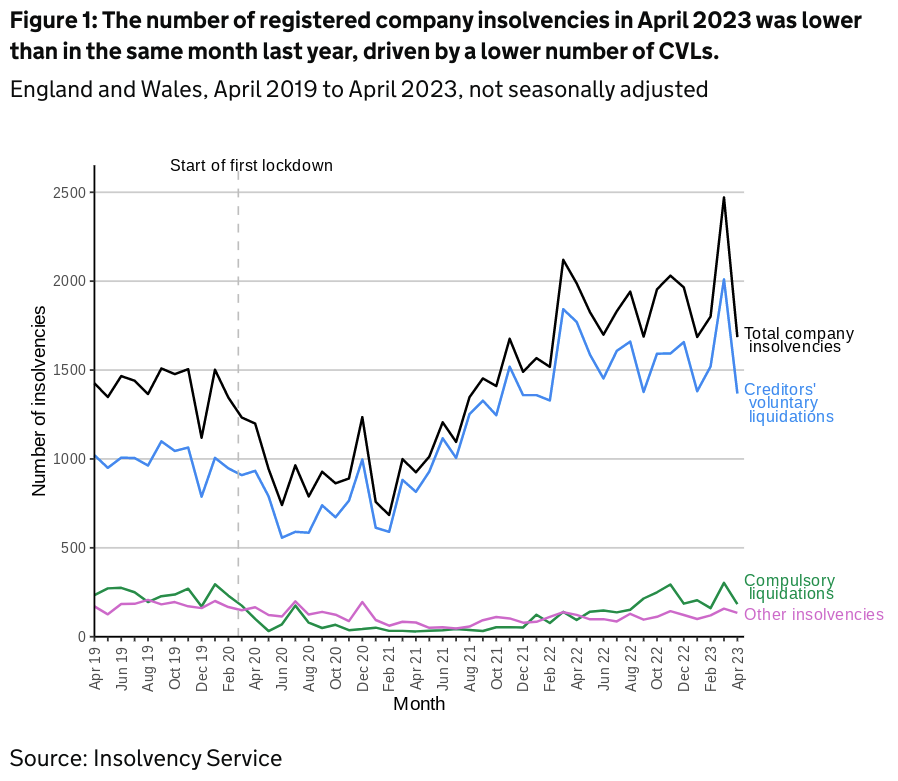

The total number of business insolvencies recorded in April in England and Wales was 1,685

This was down 15% on the total from last April but 18% higher than April 2019 – the last equivalent pre-pandemic month.

This total was down 46% from last month’s historic high and finally breaks the 23 month streak when corporate insolvencies were both over 1,000 and were higher than the corresponding monthly figure from 12 months previously.

Analysis

Of the 1,685 corporate insolvency cases recorded last month, the vast majority remain Creditor Voluntary Liquidations (CVLs) with 1,368.

This is 81% of the total number, down 1% from a month ago as a ratio but a reduction in the number of completed cases of 642.

The number of CVLs in April was 23% lower than the previous month but was 25% higher than the equivalent pre-pandemic period of April 2019.

April saw 183 compulsory liquidations which includes winding up petitions which is nearly double the number of cases from a year ago (94).

This continues to show that HMRC and other creditors are forcing more companies into liquidation in an effort to recover outstanding debts rather than continuing to let a company trade on and repay gradually over a longer time period.

There were 122 administrations recorded in April. This is up 8% from last April’s total.

Similarly there were 12 Company Voluntary Arrangements (CVAs) which is an increase of 20% on the same month a year ago.

These annual increases show that while liquidations remain the majority of cases, directors are still looking to find a way to repay their debts and keep a business operating rather than opting to close instead.

There were no receivership appointments recorded last month and there was one additional insolvency moratorium recorded with Companies House last month. This takes the total to 43 since 2020 with another business having their restructuring plan approved by a court in April bringing the total to 21.

While the number of insolvencies in April this year was 786 fewer than the previous month, this was expected as there is always a rush to complete outstanding insolvency cases if possible before the end of the financial year on March 31st. Since 2019, every April has seen a decrease on the previous month’s figures.

Scotland

In Scotland there were 114 company insolvencies in April which was a 25% increase on last month’s total and 20% higher than in April 2022.

This total consisted of 64 CVLs (up from 61); 41 compulsory liquidations (up from 40) and nine administrations (up from two). There were no CVAs or receivership appointments recorded last month.

Compulsory liquidations were historically the main driver of Scottish insolvencies but since April 2020 CVLs have been the most common by three times as many.

Northern Ireland

There were 8 company insolvencies in Northern Ireland in April which was a reduction from the 12 recorded in March. This is also lower than the 13 recorded last April.

The number of cases in Northern Ireland tends to be traditionally lower than in Scotland or England & Wales, so the percentages are more variable when one or two cases could be the equivalent of 10% or more.

The monthly total was made up of 4 CVLs (down from 8); two compulsory liquidations (same as March); and two administrations (same as March). There were no CVAs or receivership appointments recorded.

The total number of company insolvencies for the whole of the UK in April 2023 is 1,807 – a reduction of 766 cases.

“The business climate is still tough”

Nicky Fisher, President of R3, the insolvency and restructuring trade body said: “Despite the monthly fall in corporate insolvency figures, total numbers are still above pre-pandemic levels, and the key reason for this is that Creditors Voluntary Liquidations are higher than they were in 2019.

“After three years of disturbed trading and a choppy economy, it’s clear that directors have simply had enough or have realised this time is right to shut down their business while the choice is still theirs to make.

“The business climate is still tough. Firms right across the supply chain are trying to manage increased costs without passing this on to their customers, and with inflation remaining sticky, this is likely to become ever more challenging as the year progresses.

“We are also waiting to see the real impact of rising interest rates – and may not see the cumulative impact of the rate rises until later in the year as fixed term credit arrangements come to an end.

“Businesses could potentially face a credit cost shock just as inflation is predicted to ease, and could mean we’re looking at a one-step forward, one-step back situation, rather than a sustained improvement in the trading climate.

“Given this, and the ongoing challenges businesses face, we urge directors to remain vigilant and act if they see signs it might be distressed, or if they start to worry about it or its financial health.”

Last month saw historically high monthly insolvency figures, partly due to many businesses trying to get in under the wire and liquidate before the end of the financial year, and the quarterly statistics for Q1 2023 confirming that the previous 12 month period had seen the most insolvencies since records began in 1960.

In the meantime, interest rates have increased and inflation remains in double digits adding more stress and aggravation to directors, especially of small and micro businesses.

Some research indicates that nearly all – 99% – of all the corporate insolvencies in the first quarter of 2023 involved businesses with an annual turnover of less than £1 million.

So if your business is in this bracket and you’re worried about what the next few weeks and months might hold for you if things don’t improve then you should definitely get in touch with us.

We offer a free consultation to any director or business owner who wants some impartial, professional advice on what options they have.

After this they will have a clear view of what potential pathways are available to them and what the most effective choices could be.

Every business is different and there’s a wide range of strategies and solutions they can follow – if they act in time.