What happens to them has a huge effect everywhere else

Have you ever heard about newspapers and websites “burying the lede” in a story?

This is where the headline says one thing but when you start to read on you realise that more important and significant news is contained within the story itself but wasn’t mentioned earlier.

We’re starting to feel the same about our blog on the final Q1 insolvency statistics for 2023.

While as accurate and informative as ever, the Insolvency Service have noted, almost in passing, that 2022 had the most business insolvencies within a 12 month period since records began in 1960.

You’d think this would have been major headline news but it’s taken a few months for it to come out and everybody is more concerned with other news stories and has moved on.

So we thought if this was hidden (in plain sight) within the figures, what else could be in there that was significant?

As well as looking at the official insolvency figures, we’ve also gone and looked at several other sources including the always fascinating Bank Underground blog – which is where the Bank of England publish their research.

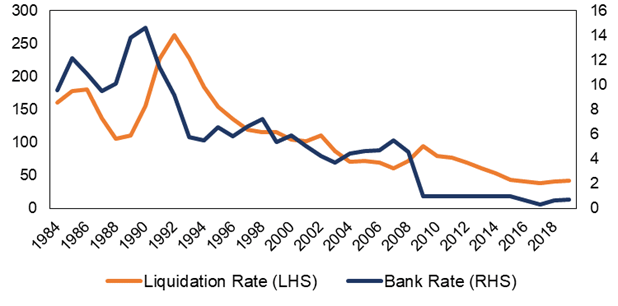

They recently posed the question of why insolvencies had grown so high when the annual liquidation rate per 10,000 companies is cyclical and was recently on a clear downward trend?

They matched this with the underlying Bank Rate – base interest rate – which showed that the long-term decline in the liquidation rate coincided neatly with a loosening in financing conditions. So the more money there was available for companies to borrow, the less likely they would be to go into insolvency.

So researchers at the bank wondered why, given that the Bank Rate was at an all-time low until 2021, did insolvencies reach an all-time high within 12 months?

In order to get the best answer, they decided to look at what had happened to the UK’s micro businesses in the past couple of years.

What is a micro business?

Most people are aware of the differences between small, medium and large businesses but what about a micro business?

The official classification is that a company is a micro business if two of the following three conditions are met:

- Have an annual turnover of £632,000 or less

- Have a balance sheet turnover of £316,000 or less

- The average number of employees is 10 or less

In 2021, there were an estimated 3.9 million micro businesses operating in the UK which accounted for 95% of all businesses in the country.

Combined, they employ nine million people and contribute £210 billion to the UK economy.

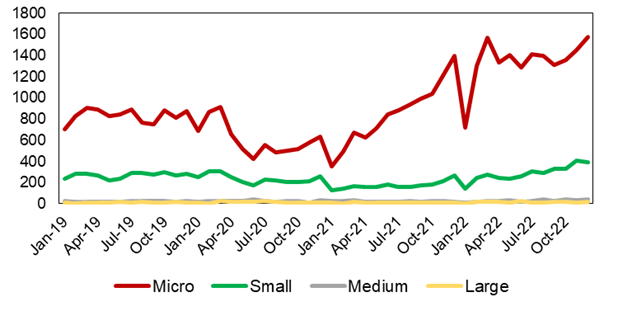

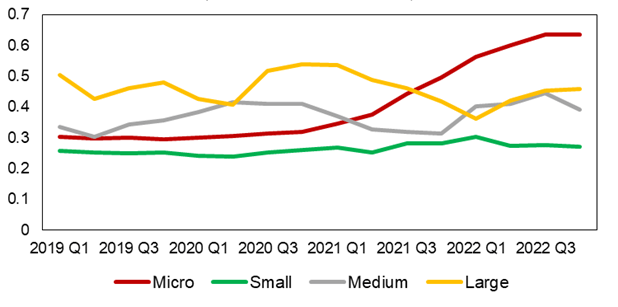

Chart 2b: Business insolvencies by company size (number of insolvencies)

Sources: Insolvency Service, Gazette and Bureau van Dijk.

Looking at the available data, it’s micro firms that are largely driving the increase in insolvencies.

In 2019, 73% of business insolvencies were attributable to micro businesses but this had risen to 81% last year.

Further research including analysing responses to the fortnightly ONS Business Insights and Conditions Survey (BICS) revealed two key findings:

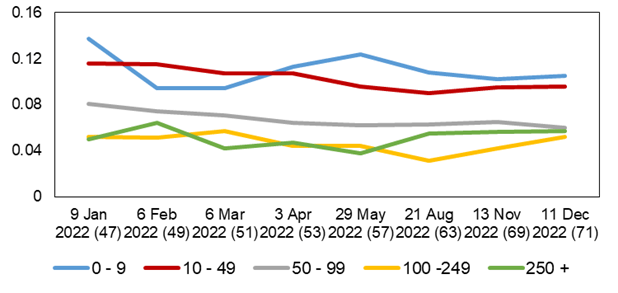

- Micro businesses considered themselves at a substantially higher risk of insolvency compared to larger companies – currently perceiving the risk to be twice as high

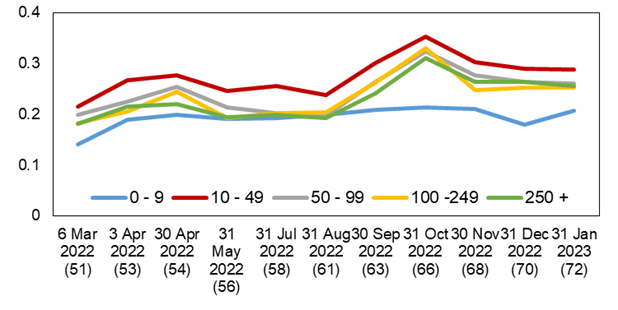

- Micro businesses are also at a disproportionately higher impact of rising energy prices

Chart 3a: BICS – Business at moderate/severe risk of insolvency (share; by number of employees)

Chart 3b: BICS – Energy prices as main concern (share; by number of employees)

Source: ONS BICS.

Because researchers work for the Bank of England, they are keen to report that the increased risk of insolvency to micro businesses will not present a material risk to the UK banking sector because it is well capitalised and “because of the unprecedented financial support provided during the pandemic will be in the form of loan schemes, some of this debt will be guaranteed by the government.”

This is based on the finding that nearly 60% of all insolvencies between May 2020 and March 2022 involved companies that had taken out a bounce back loan.

They also note that micro businesses were more vulnerable as a whole because they tended to have higher debt levels before insolvency after Covid than before showing that the debt to assets ratio of micro businesses going into insolvency was two times higher in 2022 than it was in 2019.

Chart 4: Indebtedness prior to insolvency by size (total debt/total assets)

Sources: Gazette and Bureau van Dijk.

The research concludes that while the numbers of micro (and small) businesses going into insolvency did not constitute an imminent financial stability issue, this could change as “macroeconomic challenges continue to accumulate, bounce back loan payments become due, financial conditions tighten and larger insolvencies start to crystallise.

“This is definitely a space worth watching.”

We know it’s a space worth watching because we work with hundreds of directors and business owners of small, medium and micro businesses throughout the UK every year that are trying to restructure, rescue or depending on circumstances, close their company quickly and efficiently.

Depending on their individual situations and goals, some breathing space and the chance to reform, protected from legal actions and creditors, will allow a business to emerge stronger and more resilient to future economic challenges than before.

Alternatively, closing through a company liquidation will free directors to start again, unencumbered by unsecured debts including bounce back loans.

We offer a free initial consultation to anybody who wants some timely, independent advice on what options they have to help their business.

Once they take the first step of getting in touch with us and booking their session – they can then concentrate on how they want their future to unfold – no matter how big their business or their ambitions for it.